Utilizing an aggregator enables operators to take advantage of exclusive promotions offered by game providers – tournaments and prize pools funded by tournament fees, helping operators attract customers while driving further growth. These promotions help operators keep players entertained while driving expansion.

Game library

Online casino operatorss need an expansive game portfolio in order to remain competitive in iGaming. In order to do this, they must integrate quality games from reputable software providers and offer attractive jackpots – which is both time-consuming and costly due to multiple contracts with various software developers and payment systems. Thankfully, gaming aggregators offer an effective solution by handling all paperwork and technical details for them so operators can focus their energy on marketing campaigns and consumer research instead.

Game aggregators partner with multiple and, at times, multiple gaming studios to develop an extensive library of games for their clients. Their large volumes enable them to negotiate favorable rates with game studios and avoid expensive setup fees associated with prominent developers. While iGaming aggregators usually charge mark-up fees on monthly fees for casino operators customers, their results remain comparable or more affordable than working directly with game providers.

One API integration provides access to an expansive library of game titles and is supported by round-the-clock gaming support staff from an aggregator, while maintaining and updating its library ensures continuous quality standards are maintained and met.

Before partnering with an aggregator, there are a few things you must take into account before making a decision. First, ascertain your needs and purposes; once this has been accomplished, explore potential aggregators by reading up on feedback from other operators as well as testimonials about them from them. Finally, ensure the aggregator has an impeccable reputation within their industry as they become your partner of choice.

There are various casino aggregators to choose from, but selecting the appropriate one depends on your unique business goals and needs. While certain aggregators specialize in specific genres of games, others provide more generalized approaches. It’s essential that you spend the necessary time finding one which best meets your target audience so make sure you choose carefully!

Payment options

Casino aggregators provide players with multiple payment options, including credit and debit cards. These services enable quick deposits and withdrawals while also being used to play real-money slots and table games online. It’s essential to understand how these methods operate before making deposits – this will enable you to select the appropriate option for yourself.

Payment aggregators that want to succeed in the iGaming industry must provide several key features:

Secure transactions are essential to maintaining customer trust and compliance, including data encryption, fraud detection programs and adhering to PCI DSS standards. Transaction processing speed also plays a crucial role, and casinos must work closely with their aggregators and implement innovative processing technology in order to maximize this aspect of their services.

The best casino aggregators provide multiple payment methods, including mobile payments. Furthermore, they feature user-friendly interfaces and secure connections as well as comply with national and international legal requirements while offering technical support and seamless integration into existing systems.

Bank transfers are one of the most widely-accepted casino payment methods across Europe, providing a quick and safe method to transfer funds. Though bank transfers typically take up to five days to process, some casinos do not permit wire transfers as withdrawal methods because it could potentially lead to fraud.

A good casino aggregator must offer various payment options and support for cutting-edge technologies, like blockchain. This will give it an edge in the market and attract more customers; additionally, bonuses and rewards should also be offered in order to build brand loyalty.

An outstanding casino aggregator should offer a vast selection of games from different software suppliers and collaborate with leading iGaming providers to develop innovative gaming solutions. Furthermore, they should offer comprehensive technical support, secure payment systems and regularly updated gaming databases; choosing an aggregator saves both time and resources by eliminating individual game developer negotiations.

Security

Security measures in the online casino industry are critical for keeping player personal information and funds safe, including strong encryption systems, two-step verification processes and secure payment methods. These systems can also be updated regularly to address new threats while increasing processing efficiency; furthermore, casino sites often employ certified random number generators that produce random results that ensure fair results.

Casino aggregators help operators by offering an API solution to quickly integrate content quickly and seamlessly, saving both time and resources, as well as creating a richer gaming experience for their players. Aggregators also collaborate with many game developers in providing games and software solutions.

Although some operators opt to work directly with individual developers, this can be a complicated and time-consuming process that necessitates significant manpower. Each supplier may also require their own contract and pricing structure, making the task of updating a platform both costly and laborious.

To address this challenge, aggregators provide a comprehensive solution in one session that allows them to optimize and manage all gaming portfolios from behind the site – giving players a superior gaming experience and providing technical support and maintenance of game libraries.

A high-quality casino aggregator should offer a high-quality gaming platform that exceeds industry standards and adheres to local and international gambling laws, while being reliable with proven stability and performance track records. Furthermore, they should possess a support team dedicated to handling any potential issues that may arise.

When selecting an aggregator, make sure it offers a comprehensive range of casino services, such as game selection, software, payment systems and marketing tools. A reputable aggregator should offer diverse game portfolios, simplified integration processes and scalable solutions able to expand with business needs; in addition to this it should have an in-house security infrastructure capable of keeping up with new developments within iGaming industry and meeting Know Your Customer (KYC)/Anti Money Laundering regulations in all relevant jurisdictions.

Legality

Game aggregators are essential partners for casino operatorss, helping streamline the expansion of game offerings and support growth. These companies provide a centralized platform which streamlines contract negotiations and technical integrations with numerous game suppliers – saving both time and resources while offering technical support services, cutting-edge payment systems, unified technical support capabilities and innovative payment systems all under one umbrella.

Casino aggregators partner with iGaming software and content providers to offer them to operators for a fee, eliminating costly negotiations with game studios while providing operators with an extensive library of popular games. Furthermore, these aggregators ensure legal compliance as well as fair results through certified RNG systems – an essential factor when engaging with players and keeping them playing.

Reputable aggregators will offer regular updates and promotions, enabling operators to stay abreast with the newest releases and top performing titles on their platforms. In addition, these tools and analytics provide operators with everything they need to optimize customer gaming experiences – leading them to increase player engagement, loyalty and revenue potential.

Aggregators use their volume of business to negotiate advantageous rates with game developers, often offsetting costly licensing fees from big studios. This saves operators money and allows them to focus more resources on critical aspects such as marketing campaigns or consumer research.

Partnering with a reliable game aggregator can help game operators avoid legal entanglements with gambling laws and regulations in various jurisdictions. They can assist game operators in navigating the complexities of licensing requirements for regulatory compliance, making entering new markets simpler while remaining compliant in operations.

Reliable game aggregators partner with the most sought-after gaming studios to deliver an extensive library of high-quality, innovative titles. In addition, they will offer technical support that keeps operators abreast of market trends and regulations – helping maximize the revenue potential of online casinos while optimizing their websites for performance and meeting customer expectations.

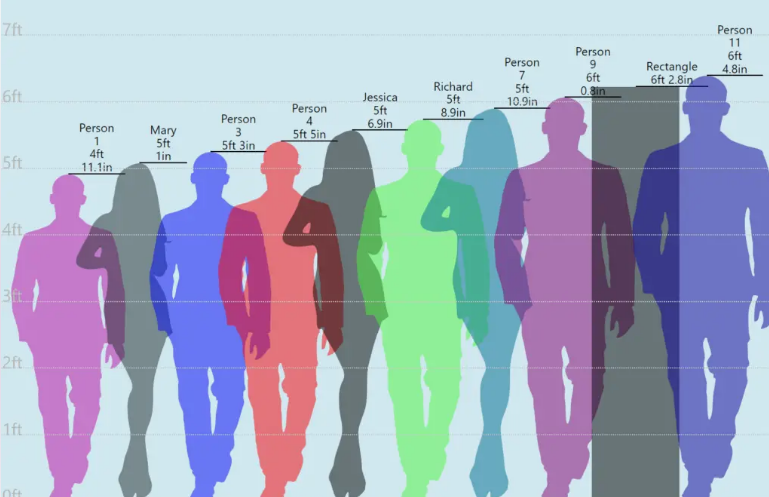

No matter the purpose, whether that means settling an amicable height dispute or just measuring landmarks accurately and easily. Height comparison tool provides straightforward measurements that give accurate results.

No matter the purpose, whether that means settling an amicable height dispute or just measuring landmarks accurately and easily. Height comparison tool provides straightforward measurements that give accurate results. Property tax in Russia is calculated based on regulations set by municipalities within the overall framework outlined by the Russian Tax Code and may include various rates, deductions and privileges.

Property tax in Russia is calculated based on regulations set by municipalities within the overall framework outlined by the Russian Tax Code and may include various rates, deductions and privileges.